crypto tax accountant canada

Our team of experts has years of experience with cryptocurrency taxes and we can help ensure that you pay the right amount of tax on your cryptocurrency gains. If the CRA is auditing you for NFT or crypto taxes it is in.

Income Tax Implications For Cryptocurrencies In Canada

For those who need to find out if you have made or lost money trading cryptos.

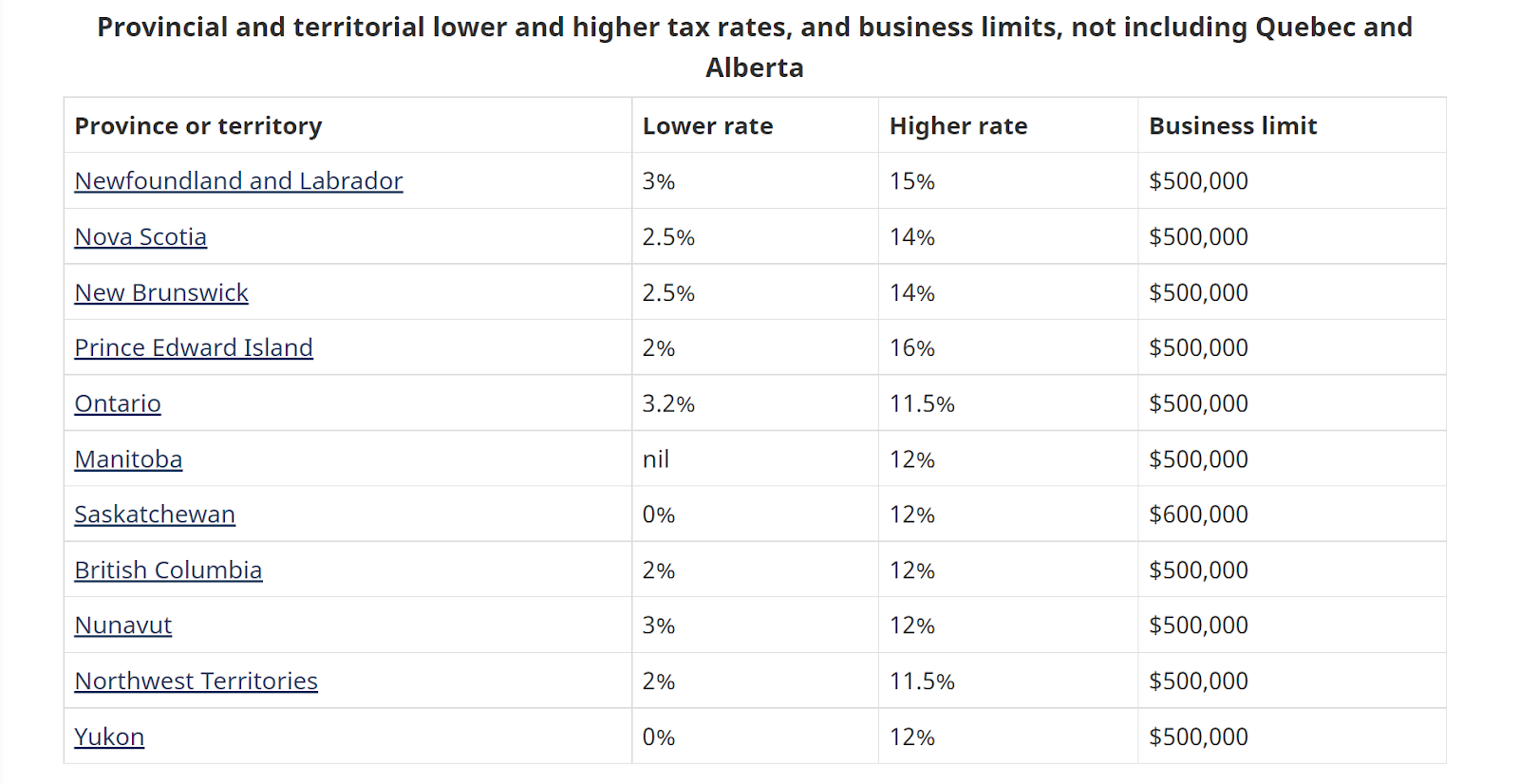

. The Canadian Revenue Agency CRA currently views crypto as a commodity. We are the first blockchain accountants in Canada and have. Also for those considering implementing crypto tokens and currency in their.

Youll pay either Capital Gains Tax or Income Tax on your. Tax Partners has been in business for over 39 years. Crypto Currencies are a taxable commodity in Canada.

Cryptocurrency is a type of digital currency or payment that may be used to buy and sell goods and services on various online platforms. The CRA initiates crypto tax audits with a letter notifying the taxpayer and a 13-page cryptocurrency audit questionnaire. Deixis is a Canadian accounting firm specializing in crypto tax and accounting services for Canadian investors.

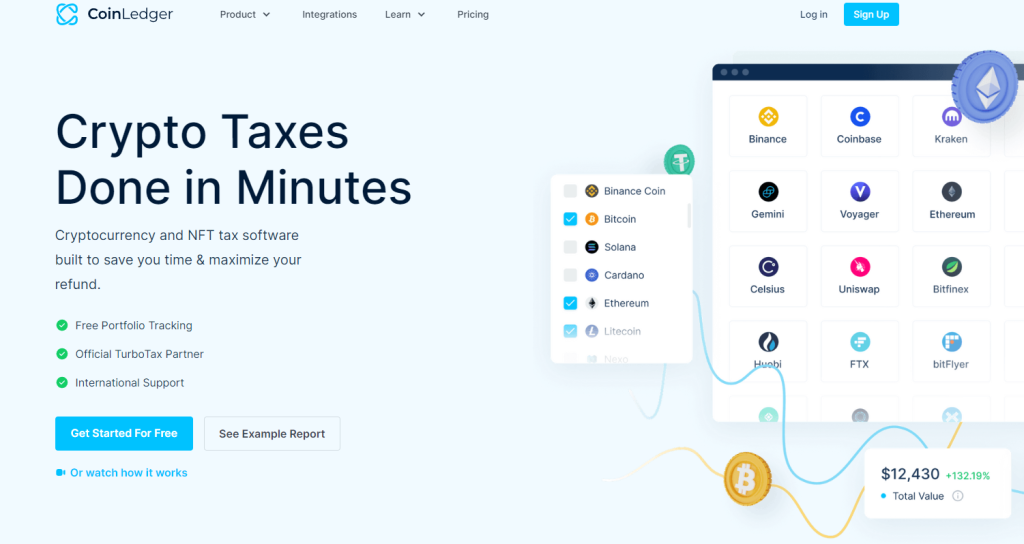

Step 1 Determine if trading of Crypto. Koinlys industry leading crypto tax software offers all the tools you need to impress your crypto investor clients catapult your business revenue. Since he purchased the BTC back in 2020 for 20K CAD he has now realized a gain of 40000 CAD.

This means that if you buy or sell crypto you will have to pay either capital gains or income tax. This gain is something that Bob would have to report on his income tax return and pay. To work cryptocurrencies rely on a sort of.

We are focused on delivering a customer experience next to no. Crypto income So first of all CRA does mandate saying that you do need to report all your income. The Canada Revenue Agency has released guidance on cryptocurrency taxes in Canada - but theyre not always straightforward.

That does include any income that youve earned from cryptocurrency. 17817 Leslie Street Unit 2 L3Y 8C6 Canada. 295 Robinson St Suite 100 Oakville Ontario L6J 1G7 Forte Innovations.

Looking for a crypto tax accountant. David Chen Associates help crypto investors to navigate their crypto tax obligations with the ATO at a reasonable cost. The Canadian Revenue Agency treats crypto currency as a commodity not a currency.

Deixis is a crypto accountant in Canada that starts you off with a crypto assessment. We specialize in deep crypto tax and business analysis traditional bookkeeping tax preparation. How we can Help Our professional accountants are well versed in calculating Crypto currency transactions and determining its tax implications.

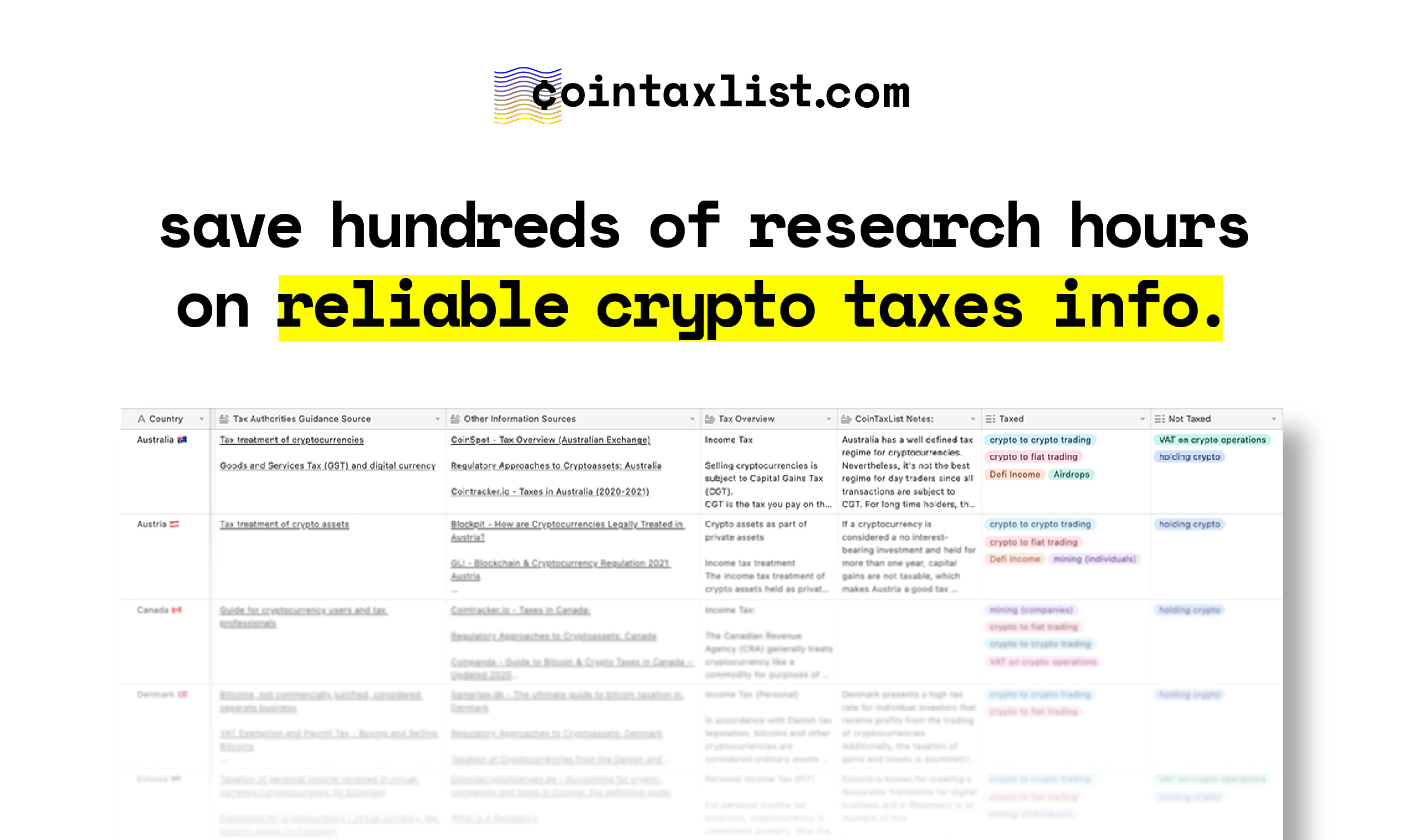

We are abreast with the rapidly evolving field of cryptocurrency and the changing laws Our clients can focus on their core business and leave crypto accounting services of crypto tax. Crypto might seem complicated - but accountants shouldnt be put off by a lack of understanding of the cryptoverse because crypto accountants have never been more in demand in Canada. Our directory of CPAs tax preparers and tax attorneys helps crypto traders help find a knowledgeable tax accountant for crypto tax advice planning.

We also offer advice on IRS. GROUND FLOOR UNIT 2 38-40 PROSPECT STREET BOX HILL. During your assessment Deixis will look for ways to minimize your crypto liabilities in both the current.

As a result its gains and losses must be. Our Company powers the financial back office for startups and small to medium businesses. We specialize in deep crypto tax and analysis traditional bookkeeping tax preparation fractional controller CFO services.

How Does Germany Taxes Crypto How Much Tax Do You Pay On Crypto In Germany Is It Really Tax Free

Best Crypto Tax Software In Canada 2022 Important Warning

Tax Treatment Of Cryptocurrency Much Still To Be Determined Says Aba Panel Wolters Kluwer

Digital Cryptocurrency Tax Accountant Faris Cpa

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Crypto Tax And Portfolio Software Cointracker

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Bought Bitcoin In 2017 Here S How Cryptocurrency Is Taxed In Canada Cbc News

6 Crypto Questions To Ask Your Tax Accountant Nextadvisor With Time

What You Should Know About Cryptocurrency Tax In Canada Moneysense

How Is Cryptocurrency Taxed In Canada Money We Have

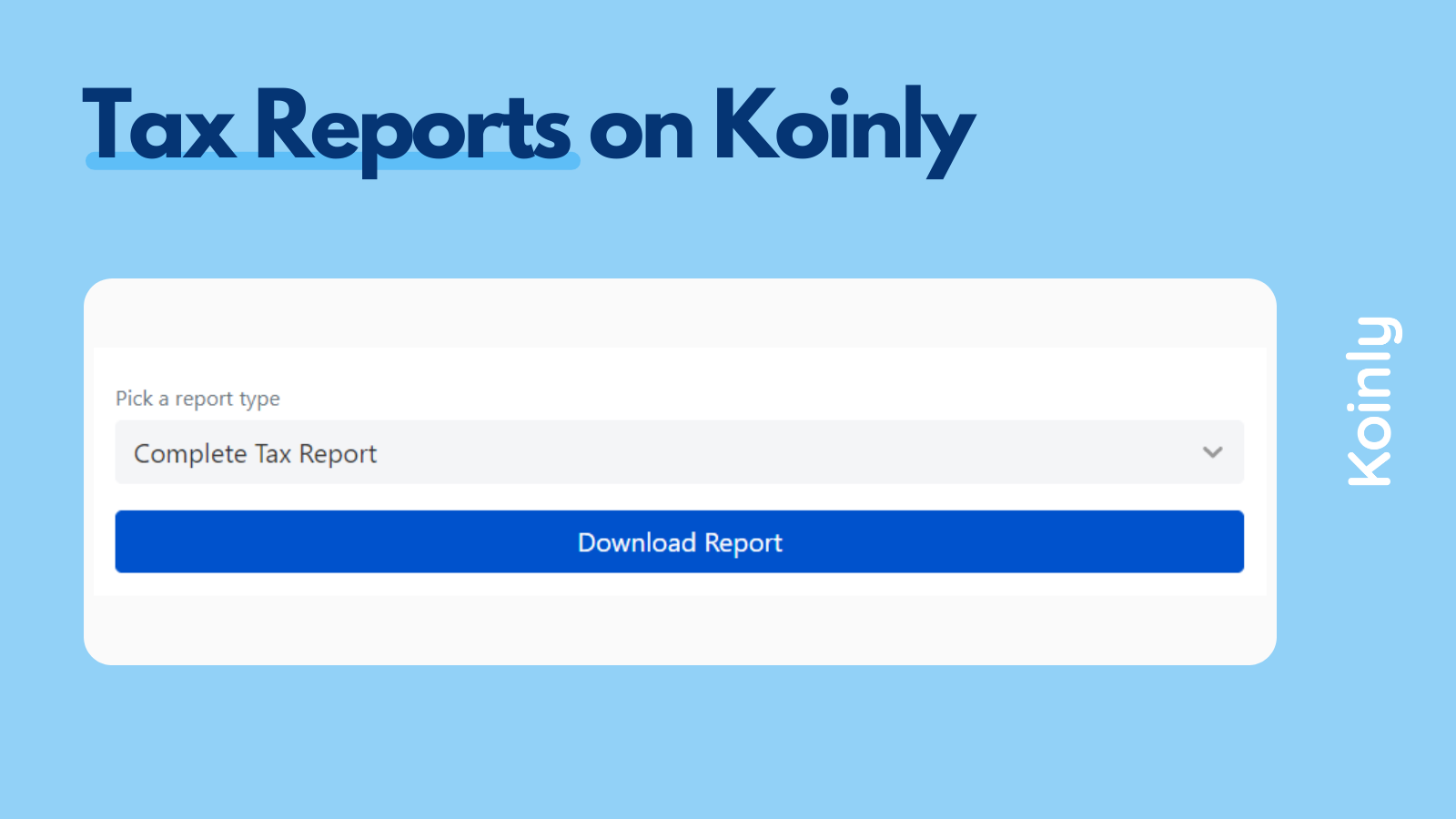

Best Crypto Tax Software For Accountants Koinly

7 Best Crypto Tax Software Of 2022 Ultimate Guide

How To Get More Accounting Clients With Crypto In Canada Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Crypto Taxes In Canada Adjusted Cost Base Explained

How To Answer The Virtual Currency Question On Your Tax Return

2022 Canadian Crypto Tax Guide The Basics From A Cpa R Bitcoinca